AUTOMATED BILLING AND INVOICING

Getting paid shouldn't be painful

Streamline your billing processes and help member tenants make the most of their experience.

Hands-off, recurring, and fully automated billing

Your coworking space managers and directors shouldn’t have to walk around to each member every month in search of payment.

Instead, the billing process for your operation can be seamless and streamlined — that’s how it is with Coworks software. No unwieldy spreadsheets, no endless paper trails, and no awkward conversations every month.

With Coworks billing, you can:

➡️ Integrate with Quickbooks or Xero for accurate accounting

➡️ Leverage best in class payments via Stripe with credit cards, IDEAL, ACSS Debit, ACH or BACS transfers

➡️ Generate revenue reports and billing metrics

➡️ Create custom billing plans based on room usage, team size, and hour allotments

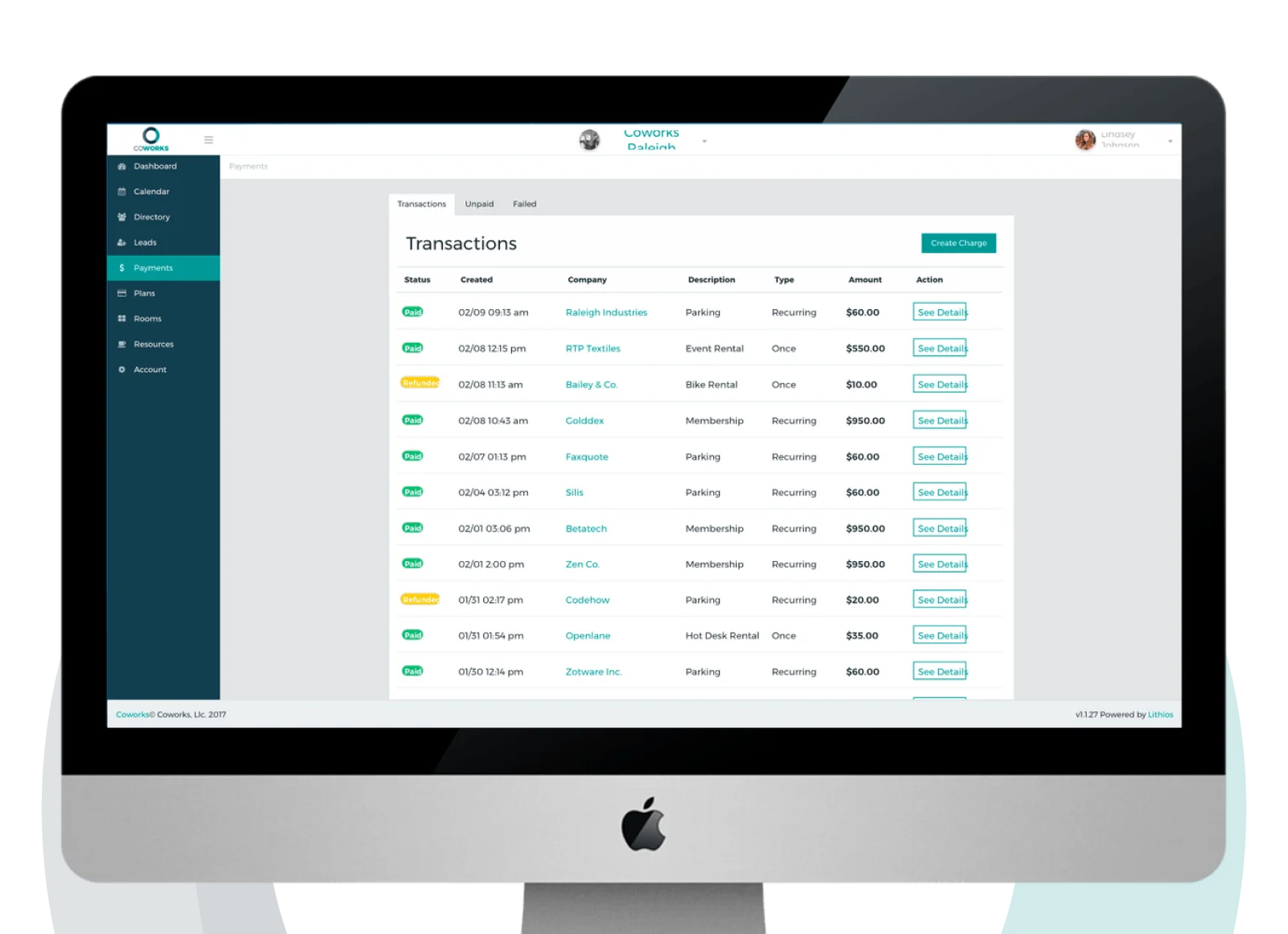

➡️ Manage the entire invoicing lifecycle, from drafts to paid to full or partial refunds

➡️ Offer flexible payments for members, such as weekly, monthly, quarterly, semi-annually or annually

➡️ Send payment reminders to prevent failed payments

➡️ Let members manage their billing details in the Coworks member app

➡️ Easily pause and resume memberships

➡️ Add quick ad hoc costs such as events or accidents

➡️ Split invoices and accept partial payments

Flexible and robust, the billing tool of Coworks is designed to help you reduce hands on time, managing invoices, collecting payments, and chasing checks.

How does Coworks integrate with accounting software such as Quickbooks and Xero?

Coworks seamlessly integrates with QuickBooks and Xero — ensuring that all your financial data is accurately recorded and easily accessible.

This integration eliminates the need for manual data entry, reducing errors and saving you time. All transactions, invoices, and payments processed through Coworks are automatically synced with your accounting software, providing a clear and consistent financial overview of your coworking space. Check our other integrations.

What payment methods can I offer my members through Coworks?

With Coworks, you can leverage best-in-class payments via Stripe, allowing your members to pay using credit cards, ACH, ACSS Debit, or BACS transfers.

This flexibility ensures that your members can choose the payment method that works best for them, improving the overall payment experience and reducing the chances of failed payments.

Can I create custom billing plans for different types of memberships or room usage?

Absolutely! Coworks allows you to create custom billing plans based on room usage, team size, credits, and hour allotments.

Whether you offer hot desks, private offices, or meeting rooms, you can tailor your billing plans to meet the unique needs of each member or team, ensuring that everyone is charged fairly and accurately.

How does Coworks help me manage the invoicing lifecycle from start to finish?

Coworks simplifies the entire invoicing lifecycle. You can easily create and send invoice drafts, track when invoices are paid, and manage full or partial refunds if necessary.

The platform also allows you to send payment reminders to prevent missed or late payments, ensuring that your cash flow remains steady and predictable.

What kind of billing metrics and reports can I generate with Coworks?

Coworks provides detailed revenue reports and billing metrics that give you insights into your coworking space’s financial health.

You can track income, analyze billing trends, and identify opportunities for growth. These reports are invaluable for making informed decisions about pricing, membership plans, and overall financial management.

Can members manage their billing details and payments directly?

Yes, members can manage their billing details directly through the Coworks Member App.

They can update payment information, view their invoices, and choose their preferred payment schedule, whether monthly, quarterly, or annually. This self-service approach reduces administrative tasks for your team and empowers members to take control of their finances.