ACCOUNTING INTEGRATION FOR COWORKING OPERATIONS

Keep the books fast with the Quickbooks integration

Bills! Bills! Bills! (Destiny's Child was not kidding.)

As a coworking space owner and operator, you need to manage income and expenses to track financial health of your space.

That's why QuickBooks is probably the most popular accounting software for small businesses . You can track money coming and going out, pay bills, generate reports, and everyones favorite: prepare taxes.

When you seamlessly integrate Coworks space management software QuickBooks Online accounting, you can keep track of invoices, payments, and customers for easier accounting and reconciliation.

Learn more about Coworks automations.

.png)

Accounting automation means more time to focus on your members.

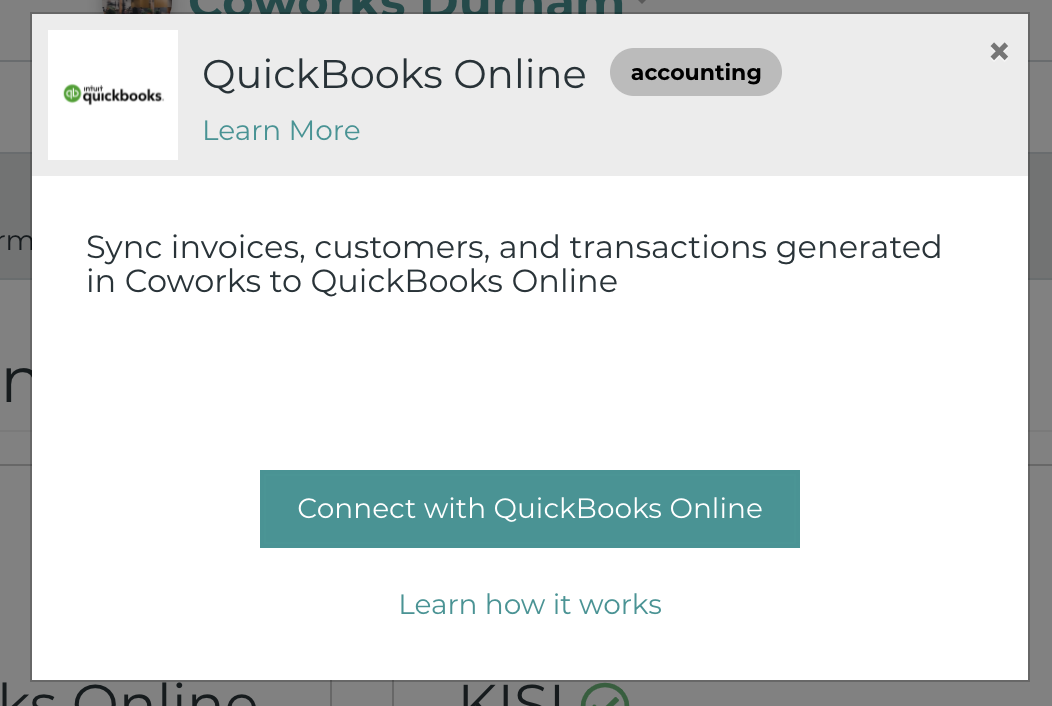

Quickbooks is one of many integrations available within the Coworks space management platform. Simply head to your integrations dashboard, and connect!

The makers of QuickBooks designed the software to be user-friendly and yet robust. A new user setup feature provides users with a virtual orientation process. In addition, most of the program’s features can be activated at the click of a button.

QuickBooks is also affordable. You can use it to run a $100,000 or $1 million business for a few hundred dollars. Your business can grow with QuickBooks. QuickBooks helps you create a business plan to use when trying to get a small business loan or line of credit or when planning for the future. QuickBooks produces a prospective balance sheet, income statement, and cash flow statement in the format recommended by the United States.S. Small Business Administration.

How do I set up the QuickBooks integration with Coworks?

Setting up the QuickBooks integration with Coworks is straightforward. Simply head to the integrations dashboard within the Coworks platform, select QuickBooks, and connect your QuickBooks Online account. Follow the prompts to configure your settings, such as choosing whether to push invoices or transactions to QuickBooks. Once set up, the integration will automatically sync data between Coworks and QuickBooks.

What options do I have for syncing data between Coworks and QuickBooks Online?

You have two options for syncing data between Coworks and QuickBooks:

- Push Invoices to QuickBooks: This option automatically pushes all invoices generated in Coworks (e.g., for monthly memberships, one-off payments) into your QuickBooks account. The system will attempt to match customers based on their email addresses, and if a match is not found, it will create a new customer in QuickBooks.

- Push Transactions to QuickBooks: This option not only generates invoices in QuickBooks but also records payments when they are made or marked as paid in Coworks. This feature helps ensure that your QuickBooks records are always up-to-date and that payments are accurately logged.

How does the integration handle customer records between Coworks and QuickBooks?

When you push invoices or transactions from Coworks to QuickBooks, the integration will first attempt to match the customer by their email address. If the customer is not found in QuickBooks, the system will automatically create a new customer record in your QuickBooks account. This ensures that your customer records are synchronized across both platforms, reducing the risk of discrepancies.

Can I track payments and close invoices in QuickBooks through the Coworks integration?

Yes, when you choose the «Push Transactions to QuickBooks» option, payments recorded in Coworks are automatically synced with QuickBooks. This not only generates the corresponding invoice in QuickBooks but also marks it as paid when the payment is recorded in Coworks. This helps keep your accounting records accurate and up-to-date, allowing you to manage deposits and close invoices efficiently.

What kind of reports can I generate with the QuickBooks and Coworks integration?

With the QuickBooks and Coworks integration, you can generate a wide range of financial reports, including balance sheets, income statements, cash flow statements, and more.

These reports provide insights into your space’s financial performance and help you make informed business decisions. QuickBooks also supports the creation of prospective financial statements, which can be useful for business planning and securing funding.