Every year, the Urban Land Institute (ULI)—one of the most respected organizations in real estate and land use—publishes its Emerging Trends in Real Estate® report, offering a forward-looking analysis of the industry’s most critical shifts.

This report is informed by thousands of real estate professionals, investors, and developers, providing deep insights into what’s next for the built environment.

This report is informed by thousands of real estate professionals, investors, and developers, providing deep insights into what’s next for the built environment.

And for coworking and flex space operators — and the tech companies that service them like Coworks — these insights are invaluable.

They reinforce what we now see happening on the ground: the demand for flexibility, collaboration, and high-quality office experiences is stronger than ever. While return-to-office mandates are still debated, the reality is that businesses are rethinking how they use office space, and flexible work environments are emerging as a solution.

And because coworking managers and flex office professionals have little free time, I highlighted the key trends from the report that directly impact coworking spaces, flex offices, and the shift toward a more agile commercial real estate model. The actual report is 138 pages, so sit down with some coffee to read it!

Spoiler: This is a moment of transformation for our industry, one where operators who understand these trends can position themselves for long-term success.

Key trends, statistics, and practices

Coworking spaces and flex offices

- The shift to hybrid work continues, with 53% of Canadian employees working in hybrid arrangements and 30% working remotely full-time.

- The demand for high-quality office space is rising, while older, less desirable office spaces are struggling to attract tenants.

- Companies are rethinking office use and prioritizing collaborative environments and tech-enabled flexibility over traditional office models.

- Flight to quality is real: 6% of Class A buildings account for 25% of leasing, highlighting the demand for premium office experiences.

- The integration of technology for reserving desks, planning meetings, and organizing office visits is increasingly important to hybrid workers.

Fractional office use and return-to-office mandates

- Companies are still downsizing their office footprints, with many planning to cut 20–25% of their office space over the next three to five years.

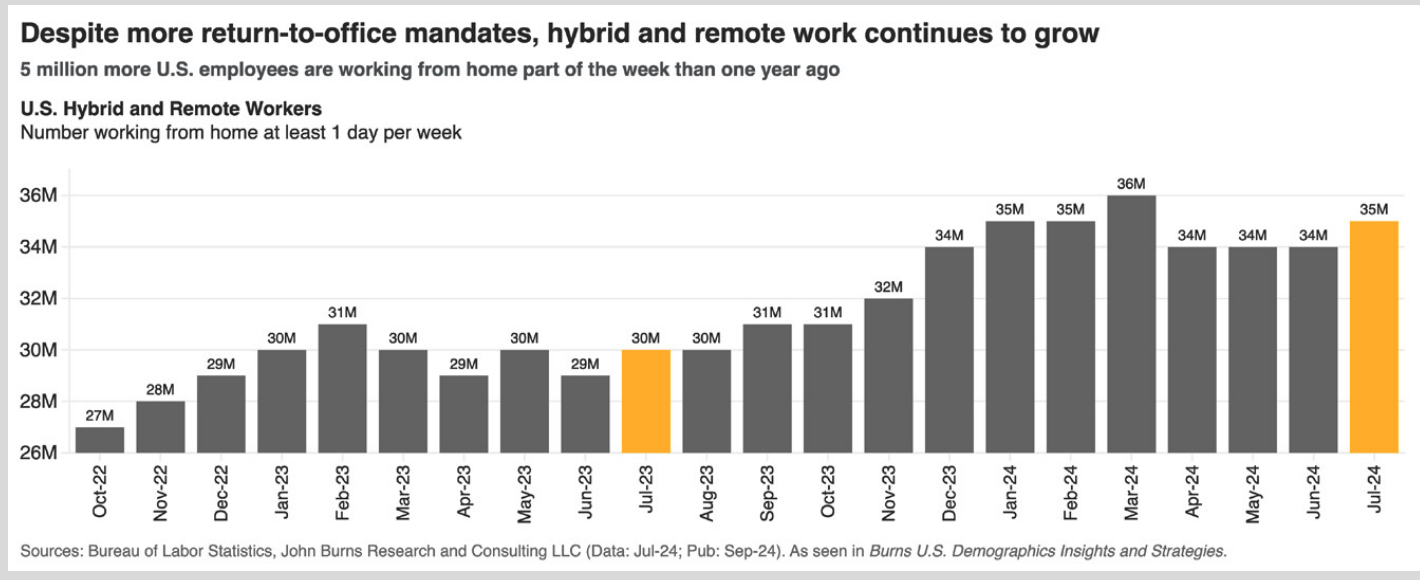

- The return-to-office push has plateaued, with two-thirds of employees still following a hybrid or remote schedule.

- Some companies are realizing they have downsized too much, noticing a negative impact on corporate culture and collaboration.

- Transit access is a key factor in office demand—buildings near commuter hubs attract more tenants, while poorly located offices struggle.

Collaborative communities and evolving office spaces

- Office spaces are being redesigned to focus on collaboration, mentoring, and wellness, incorporating health services, financial counseling, and fitness facilities.

- Mixed-use developments are becoming more attractive, with urban areas shifting from an office-dominated model (70% office) to a more balanced mix of residential, retail, and entertainment.

- Office-to-residential conversions are being explored but are often financially unfeasible, with only 2.7% of office buildings considered prime candidates for conversion.

- Cities like Boston are offering up to 75% tax breaks for office-to-residential conversions.

- The coworking and flexible space sector may benefit as companies seek more agile, cost-effective solutions without committing to long-term leases.

Summary & strategic insights

Let's distill this down even more. Remember: 138 pages.

These insights focus on how shifting office demand, hybrid work patterns, and commercial real estate challenges are shaping the future of flexible workspaces. By identifying key statistics, behavioral shifts, and emerging CRE strategies, we hope to provide practical recommendations for space operators looking to position themselves for growth.

- Leverage the hybrid work trend: The continued dominance of hybrid and remote work means coworking spaces can position themselves as a key solution for flexible work arrangements. Marketing should highlight convenience, collaboration, and technology-enabled space reservations.

- Premium experiences drive demand: Since companies prefer high-quality, well-located office space, coworking spaces should focus on offering premium amenities—well-designed spaces, seamless tech integration, wellness features, and proximity to transit hubs.

- Cater to downsizing companies: With many firms cutting their office footprint by up to 25%, there’s an opportunity to provide fractional office solutions, hot desking, and on-demand meeting spaces.

- Adapt to urban revitalization trends: As cities move towards mixed-use developments, coworking operators should integrate community-oriented programming, networking events, and partnerships with retail and entertainment venues.

- Support corporate culture needs: Companies that downsized too much are now reinvesting in physical workspaces. Coworking spaces can market themselves as a solution to foster collaboration, mentorship, and culture-building.

- Capitalize on office market distress: The high office vacancy rate and flight to quality indicate an opportunity to secure premium locations at lower costs, either through partnerships with struggling landlords or by acquiring distressed assets.

- Government incentives for space conversion: Some cities offer tax incentives for converting office spaces to other uses. Coworking space operators should explore partnerships with municipalities and landlords to repurpose underutilized office space. This is a bit of a moving target now, but worth exploring locally.

- Expand flexible offerings for corporate clients: Businesses hesitant about long-term leases may seek more fractional or flexible workspace solutions. Offering tailored plans for companies transitioning from traditional offices could be a strong strategy.

Why commercial real estate leaders should pay attention to flex office models

For those in commercial real estate (CRE)—from landlords to property investors—there’s a growing urgency to rethink traditional leasing models. This ULI Emerging Trends report makes it clear: the demand for office space is changing, and the old way of doing business isn’t coming back.

Flex office models make sense in 2025 and beyond

- Companies are downsizing, not disappearing. Many businesses are reducing their office footprints by 20–25%, but that doesn’t mean they don’t need space. Instead, they need space on their terms—scalable, flexible, and with premium amenities.

- High vacancies are reshaping office economics. Traditional long-term leases are losing favor, and spaces that once commanded high rents are now struggling to attract tenants. Converting portions of a commercial building into flex space offerings can help fill gaps and keep occupancy rates strong.

- Flight to quality is real. Companies that are keeping office space want high-end, tech-enabled, collaborative environments. Flex office models—whether coworking spaces or corporate memberships—cater to this exact demand.

- Commercial landlords need new revenue streams. A flex model introduces shorter lease terms, diversified tenant bases, and dynamic pricing, allowing landlords to mitigate risk in uncertain markets.

What this means for the flex office and coworking industry

If you’re a property owner or real estate investor, now is the time to explore flex models, coworking partnerships, and fractional office strategies.

The data suggests that businesses will continue embracing hybrid work, which means the demand for high-quality, short-term office solutions will only grow. Integrating flex office solutions into traditional buildings could be the key to staying competitive in this rapidly shifting market.

Coworking and flex space operators already understand what the data makes clear: the future of work is about choice, experience, and adaptability. Businesses need spaces that meet them where they are—not just a desk, but a workplace strategy.

At Coworks, we are on the front lines. We work with operators who are growing, evolving, and adapting their spaces to meet the new demands of hybrid work and community-driven workplaces.

For those in coworking, flex office management, or commercial real estate, the message is clear: this is your moment to lead. The demand is here, the opportunity is growing, and the businesses that embrace flexibility now will define the next era of workspaces.

I can’t wait to see what we build together next!